The financial sector is undergoing a revolutionary transformation, fueled by the rapid advancements in financial technology (Fintech). This evolution is not just reshaping the way financial transactions are conducted but is also setting the stage for a more inclusive, efficient, and secure financial ecosystem. As we stand on the brink of this financial revolution, understanding the emerging trends in Fintech innovation is crucial for anyone looking to navigate the future of finance successfully. This article explores the key trends driving Fintech innovation and how they are poised to redefine the financial landscape.

Decentralized Finance (DeFi)

The Rise of DeFi Decentralized Finance (DeFi) represents a shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on blockchain. DeFi platforms offer a wide array of financial services, including lending, borrowing, and trading, without the need for intermediaries like banks or financial institutions.

Implications for the Financial Ecosystem DeFi is democratizing finance by making it more accessible to underserved populations around the world. However, it also poses regulatory challenges and security risks, necessitating innovative solutions to ensure its sustainable integration into the broader financial system.

Artificial Intelligence and Machine Learning

Enhancing Customer Experiences and Operations AI and machine learning are revolutionizing customer service and operational efficiency in finance. From chatbots offering personalized banking advice to algorithms detecting fraudulent transactions, these technologies are enhancing the accuracy and speed of financial services.

Predictive Analytics in Financial Planning Fintech companies are leveraging AI to offer predictive analytics in financial planning, providing consumers with insights into spending patterns, investment opportunities, and risk management, thereby empowering them with data-driven decision-making tools.

Blockchain Beyond Cryptocurrencies

A Secure Infrastructure for Financial Transactions Blockchain technology is finding applications beyond cryptocurrencies, serving as a secure and transparent infrastructure for various financial transactions. Its potential for reducing fraud, lowering costs, and improving transaction speeds is being explored in areas like cross-border payments, smart contracts, and digital identities.

Tokenization of Assets The tokenization of assets—converting physical and non-physical assets into digital tokens on a blockchain—promises to enhance liquidity and transparency in asset trading. This could revolutionize investment in real estate, art, and other traditionally illiquid assets.

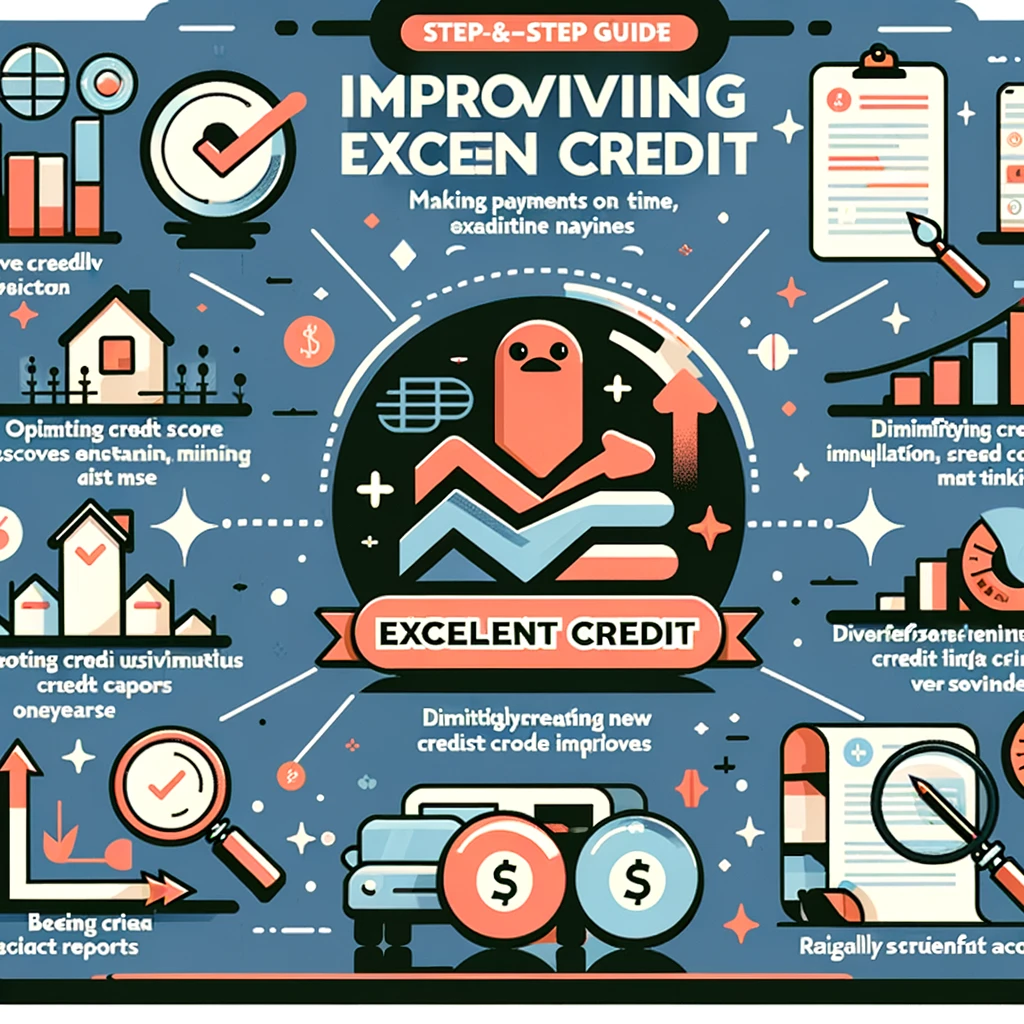

Mobile Payments and Digital Wallets

The Surge in Mobile Financial Services The proliferation of smartphones has led to a surge in mobile payments and digital wallets, making financial services more accessible and convenient. This trend is particularly impactful in developing countries, where mobile fintech solutions are bridging the gap in financial inclusion.

Innovations in Payment Technologies Emerging payment technologies, including Near Field Communication (NFC) and QR codes, are simplifying transactions and enhancing the user experience. The future may see the integration of biometric authentication, further securing and streamlining the payment process.

Regulatory Technology (RegTech)

Navigating the Regulatory Landscape As fintech innovations accelerate, so does the complexity of the regulatory landscape. RegTech solutions are emerging to help companies navigate this environment more efficiently, using technology to ensure compliance, monitor risks, and report accurately.

The Role of RegTech in Promoting Innovation By reducing the burden of compliance and risk management, RegTech is not only helping financial institutions and fintech startups operate more smoothly but is also promoting further innovation in the financial sector.

Conclusion

The future of finance is being rewritten by fintech innovation. From the democratization of finance through DeFi to the transformative potential of AI, blockchain, and mobile technologies, these trends are setting the course for a more inclusive, efficient, and secure financial ecosystem. As we navigate this evolving landscape, staying informed and adaptable will be key to leveraging the opportunities presented by fintech innovation.