In the ever-changing landscape of investment, staying ahead means not only understanding the markets but also recognizing the broader economic indicators that drive market trends. These indicators provide invaluable insights into the health of the economy, influencing investment decisions across all asset classes. This guide dives into the key economic indicators every investor must know to make informed decisions, optimize investment strategies, and navigate the complexities of the financial world with confidence.

Gross Domestic Product (GDP)

GDP: The Economic Barometer Gross Domestic Product (GDP) measures the total value of all goods and services produced over a specific time period and is a primary indicator of economic health. A rising GDP indicates a growing economy, often translating to higher corporate earnings and stock market performance. Conversely, declining GDP figures can signal economic downturns, impacting investor sentiment and market stability.

Unemployment Rate

Unemployment Rate: The Workforce Mirror The unemployment rate reflects the percentage of the labor force that is jobless and actively seeking employment. Low unemployment rates are typically indicative of economic strength, bolstering consumer spending and corporate profitability. High unemployment, however, can signify economic distress, affecting consumer confidence and spending patterns.

Consumer Price Index (CPI)

CPI: The Inflation Gauge The Consumer Price Index measures the average change over time in the prices paid by consumers for a basket of goods and services. CPI is a direct indicator of inflation, affecting purchasing power and the real value of money. For investors, understanding inflation trends is crucial for adjusting portfolio allocations, especially in fixed-income investments, to hedge against inflationary pressures.

Interest Rates

Interest Rates: The Cost of Money Interest rates, set by a country’s central bank, influence the cost of borrowing money. Lower interest rates can stimulate economic growth by making borrowing cheaper, benefiting stocks but potentially harming the value of fixed-income investments. Higher rates, intended to curb inflation, can slow economic growth but may increase the appeal of bonds and savings accounts.

Manufacturing and Services Indexes

PMI and ISM: The Industrial Pulse The Purchasing Managers’ Index (PMI) and the Institute for Supply Management (ISM) Index provide insight into the manufacturing and services sectors’ health. Figures above 50 indicate expansion, while those below 50 signal contraction. These indexes can predict economic trends, as the industrial and service sectors are critical components of the economy.

Consumer Confidence and Sentiment Indexes

Consumer Confidence: The Mood of the Market Consumer confidence and sentiment indexes measure how optimistic or pessimistic consumers are about their financial prospects and the state of the economy. High consumer confidence can lead to increased spending and investment in the economy, driving market growth. Low confidence can signal economic uncertainty, prompting caution among investors.

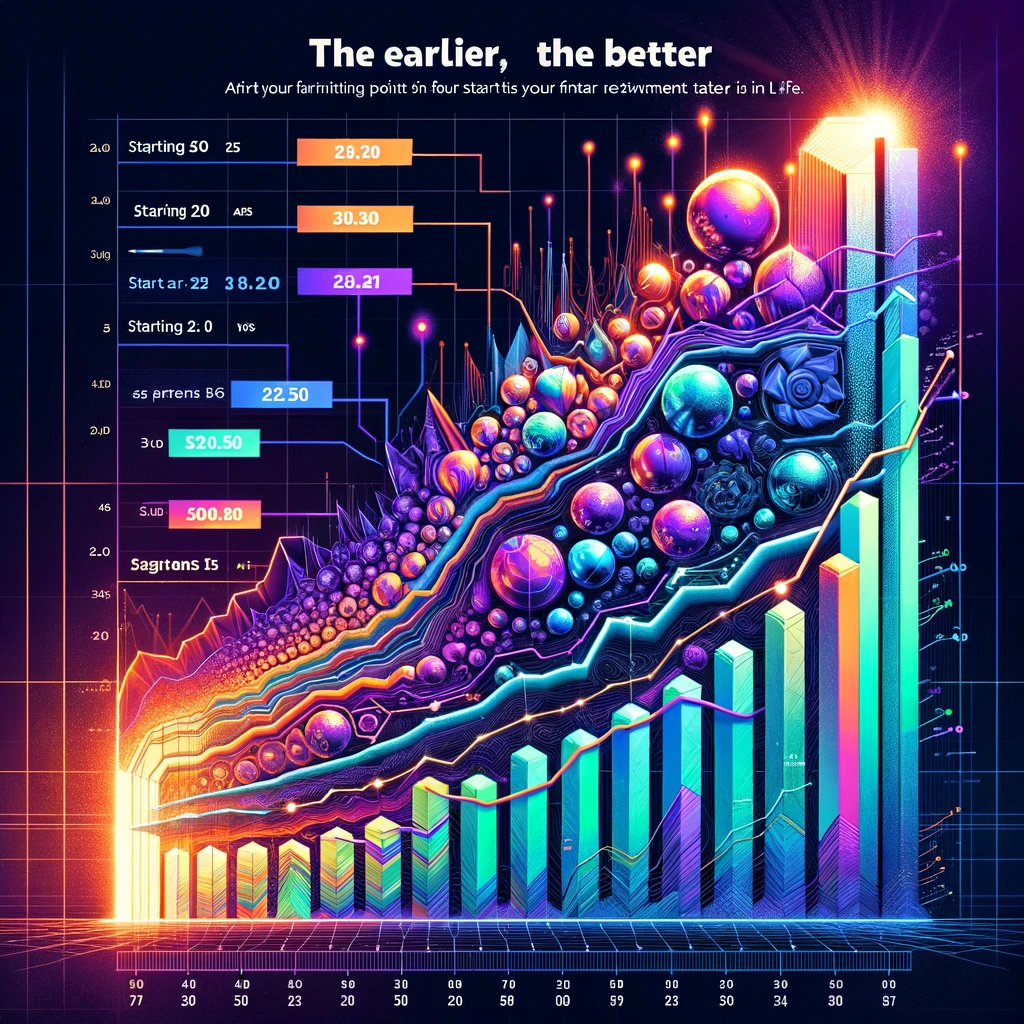

Enhancing Engagement with High-Value Content

Visual Data Presentations Infographics and charts translating complex economic data into understandable visuals can significantly increase content engagement. These visuals allow readers to grasp quickly and remember key economic indicators and their implications.

Real-World Examples Incorporating case studies that demonstrate how shifts in economic indicators have historically affected investment portfolios can provide practical insights and strengthen the article’s relevance and value.

Interactive Analysis Tools Offering interactive tools that allow users to simulate how changes in these indicators might affect different investment strategies can engage readers deeply, providing a hands-on understanding of economic impacts on investments.

Conclusion

For investors, mastering the understanding of these economic indicators is akin to possessing a roadmap for navigating the investment landscape. By keeping a pulse on these metrics, investors can anticipate market movements, make data-driven decisions, and build robust investment portfolios resilient to economic fluctuations.