Financial crises have periodically reshaped economies around the world, leaving a trail of lessons on how to navigate turbulent financial waters. From the Great Depression of the 1930s to the 2008 financial crisis, each event offers unique insights into managing and recovering from economic downturns. This guide delves into historical financial crises, extracting crucial lessons and strategies to help individuals and policymakers prepare for and respond to future financial instabilities.

Understanding Financial Crises

Defining a Financial Crisis A financial crisis is typically characterized by a sudden and significant decline in asset prices, the failure of financial institutions, and a severe contraction in credit availability, often leading to bankruptcies, economic downturns, and severe impacts on society’s wealth and employment levels.

Common Causes of Financial Crises Historically, financial crises have been triggered by a mix of factors including excessive borrowing, financial speculation, regulatory failures, and external shocks. Understanding these causes can help in developing preventive measures.

Lessons from Major Financial Crises

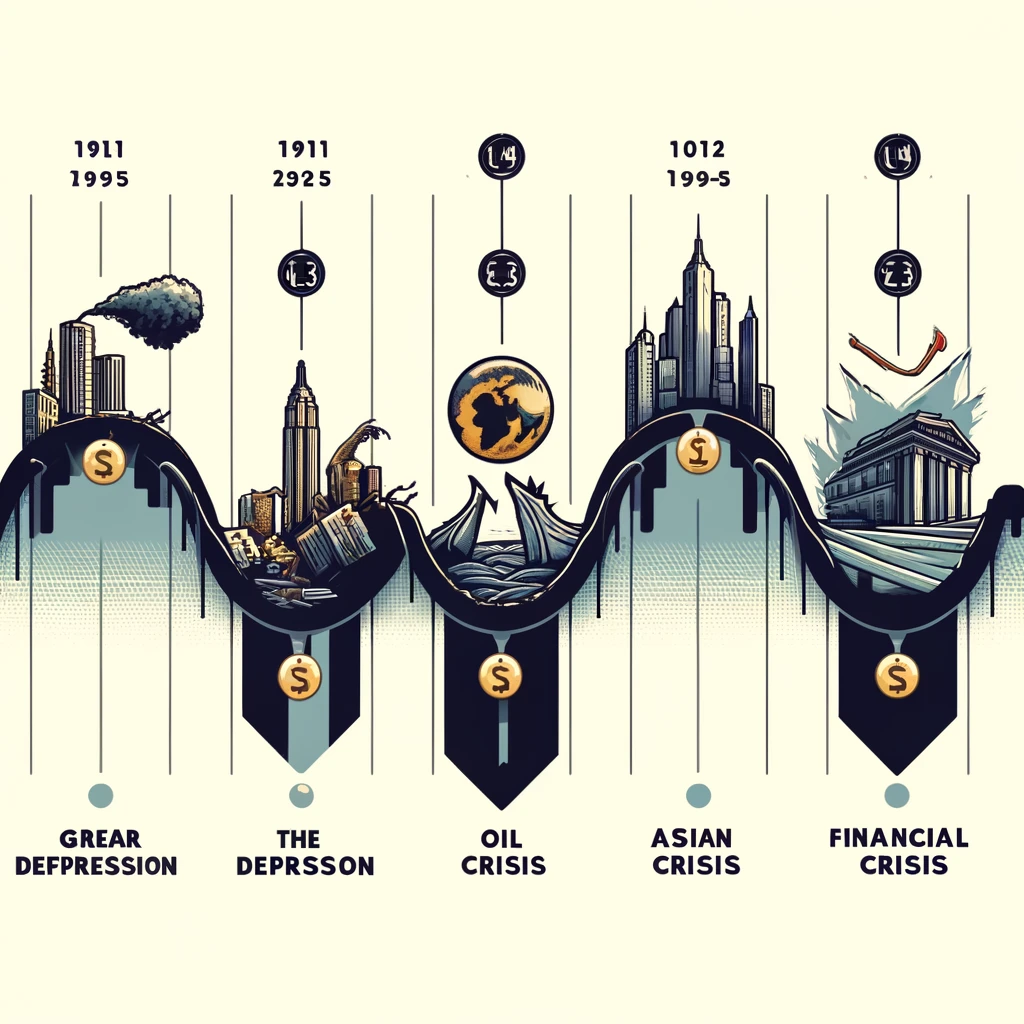

The Great Depression (1929) The most profound economic downturn of the 20th century taught the importance of governmental role in the economy. The introduction of the New Deal, a series of programs and projects to foster economic recovery and social reforms, underscored the need for significant government intervention during economic collapses.

The Oil Crisis (1973) The oil embargo by OAPEC (Organization of Arab Petroleum Exporting Countries) against the United States showed the vulnerability of economies to energy supplies, highlighting the importance of energy diversification and the need for strategic petroleum reserves.

The Asian Financial Crisis (1997) Starting in Thailand and spreading across Asia, this crisis underlined the dangers of heavy foreign investment without adequate financial controls, leading to improvements in financial regulation and oversight.

The Global Financial Crisis (2008) Triggered by the collapse of housing bubble in the U.S., the 2008 crisis emphasized the risks inherent in complex financial products like derivatives and the consequences of excessive risk-taking by banks. It resulted in comprehensive regulatory reforms designed to increase transparency and reduce risk in the financial system.

Strategies for Navigating Financial Crises

Diversification of Investments One key lesson is the importance of diversification in investments. Spreading assets across various sectors and regions can mitigate risks associated with a financial crisis.

Building Emergency Savings Having accessible emergency savings can provide a crucial buffer against sudden financial shocks, reducing the need to liquidate investments at a loss during market downturns.

Continuous Financial Education Staying informed about financial markets and understanding the indicators of potential crises can enable individuals and policymakers to react more swiftly and effectively.

Strengthening Financial Regulations For policymakers, strengthening financial oversight and regulations can prevent financial markets from becoming overly speculative and vulnerable to large-scale crises.

Conclusion

Financial crises, while challenging, provide valuable lessons that can fortify individuals and economies against future shocks. By learning from history, implementing robust financial strategies, and preparing for potential downturns, societies can navigate crises with greater resilience.